Unlocking the Keys to Effective Car Loan Applications and Approval Procedures

Browsing the complexities of lending applications and approval procedures can typically seem like understanding a cryptic code. However, there are key approaches that can significantly boost your opportunities of success in safeguarding the funding you need. By comprehending the intricate dancing in between finance requirements, credit rating, lender choice, financial document organization, and application preparation, people can position themselves for beneficial outcomes in the usually challenging world of financing. These keys, when introduced, hold the power to change the funding application journey right into a smoother and extra gratifying experience.

Understanding Lending Requirements

When applying for a financing, it is essential to completely understand the certain requirements established by the lending institution. These needs offer as the structure upon which your lending application will be evaluated and accepted.

In addition, meeting all the stipulated needs boosts your chances of protecting the financing with beneficial terms and conditions. Failing to fulfill these standards could result in delays or potential rejection of your car loan application, highlighting the relevance of comprehending and fulfilling the lender's demands.

Improving Credit Report

Recognizing and satisfying the particular finance requirements set by borrowing institutions lays a strong structure for borrowers to focus on boosting their credit rating ratings, a crucial variable in the lending authorization procedure. In addition, preserving a much longer credit history and staying clear of regular debt inquiries can show security to possible lending institutions. By actively taking care of and improving their debt ratings, debtors can improve their possibilities of safeguarding finance approval at desirable terms.

Choosing the Right Lender

In addition, assess the lender's car loan terms, including the settlement period, rates of interest, charges, and any surcharges. It is vital to pick a lending institution whose terms are desirable and line up with your financial abilities. Look for transparency in the funding procedure to avoid concealed charges or unforeseen conditions. By meticulously selecting a loan provider that fits your needs, you can increase the probability of an effective lending application and approval process.

Organizing Financial Documents

Effectively organizing economic papers is a fundamental step in preparing for a finance application. Arrange these documents in a methodical manner, organizing them by classification and personal line of credit date to help with easy access and understanding for both yourself and the loan provider.

In addition, include documentation pertaining to any kind of outstanding financial obligations, such as charge card declarations, trainee loans, or existing mortgages. Offering a comprehensive review of your economic responsibilities will give loan providers a more clear photo of your ability to tackle additional financial obligation. Be prepared to submit individual recognition records, such as a motorist's permit or key, to confirm your identity.

Preparing a Solid Application

Having actually carefully arranged your economic documents, the following crucial read the full info here step in the direction of a successful funding application is crafting a compelling and detailed entry. Begin by submitting the application precisely, making sure that all areas are finished with exact details. Be clear about your financial situation, providing details on your income, expenses, possessions, and obligations. It is necessary to include any additional documentation that supports your application, such as pay stubs, tax returns, financial institution statements, and evidence of home credit loan collateral if suitable.

:max_bytes(150000):strip_icc()/GettyImages-111950239-56a066b63df78cafdaa16b2c.jpg)

Conclusion

In final thought, successful loan applications and approval procedures rely on meeting the financing needs, enhancing credit report, choosing the suitable lending institution, organizing economic files, and sending a strong application. Easy to find a Fast Online Payday Loan. By recognizing these key variables and taking the needed actions to address them, individuals can raise their chances of protecting a car loan and attaining their financial goals. It is vital to be well-prepared and proactive in the funding application procedure to make sure a smooth and effective end result

Ralph Macchio Then & Now!

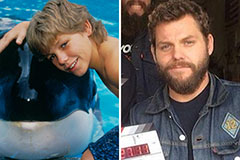

Ralph Macchio Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Destiny’s Child Then & Now!

Destiny’s Child Then & Now! Robbie Rist Then & Now!

Robbie Rist Then & Now! Erika Eleniak Then & Now!

Erika Eleniak Then & Now!